Many folks are having some issues with mailed in federal tax payments to the IRS. Common problems are returned payments and uncashed checks. With IRS offices closed or at limited capacity, the normal isn't always such right now.

If you'd like to make payments electronically, here's how.

ONLINE FEDERAL TAX PAYMENT PROCESS

The steps below allow you to pay your federal income taxes AND federal quarterly estimated tax payments online via the IRS website. You will get a confirmation number for proof of payment which allows you to later look up payments and check processing status. You may opt to receive email verification on the status of your payment. This method does not require account setup, such as EFTPS and can be done immediately. You may pay via checking account which is free, or via debit/credit card which has fees.

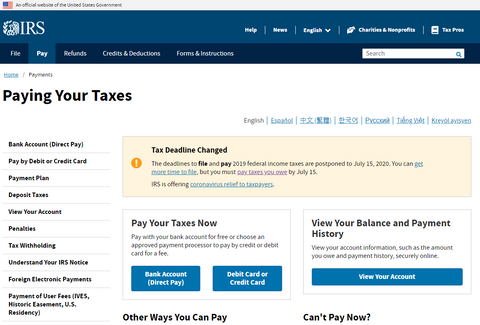

STEP 1: Use this link to log into the IRS's payment site

STEP 2: Main page: under Pay Your Taxes select bank account for free payments or debit/credit card (fee applies)

STEP 3: Reason for payment is either Tax Return or Notice if paying a balance due (what's portrayed below) OR select Estimated Tax Payment if your paying a quarterly estimated payment for 2020.

Always select apply payment to 1040, 1040A, 1040EX, portrayed below

Tax period is VERY important. This is the year your payment will be applied against. Select 2019 if you are paying the balance owed on your 2019 federal income tax return. If you are paying 2020 estimated quarterlies, select 2020.

STEP 4: Verify Identity - this is how the IRS verifies who you are. Notice the red box that says it was unable to identify Bill. That's because we selected a tax year of 2019 when our return had not been efiled yet. By selecting 2018, we were able to successfully be identified. If you get the same error as this using 2019, try 2018. Notice the note: "the Tax Year for Verification you enter here does not have to match the tax year for your payment."

Select married filing joint, single etc based on how the selected year was filed.

Use the name, address and SSN of the first taxpayer listed on your 1040.

STEP 5: you're almost there! The rest of the screens are for payment info and basic data you can easily handle. If you would like to receive an email notification of your payment status select that option, we recommend doing this.

You can print out a nice confirm at the end with a confirmation number. SAVE THIS with your tax records. It can be used to look up payments later on and verify proof of payment.